Oklahoma residents often ask why they pay more for insurance than people in other states. As experts at AAA Zoellner Insurance, we see these bills every day. While Oklahoma offers a low cost of living in many areas, insurance is a major exception. In 2026, Oklahoma continues to rank near the top for both Home Insurance and Car Insurance premiums.

Key Takeaways:

Insurance rates do not go up because of a single factor. Instead, a combination of severe weather, high numbers of uninsured drivers, and a unique regulatory environment creates a “perfect storm” for high costs.

The Geography of Risk

Geography drives most of the cost differences. Oklahoma sits in the heart of “Tornado Alley” – a high-cost reality for insurance carriers.

Tornado Frequency and Impact

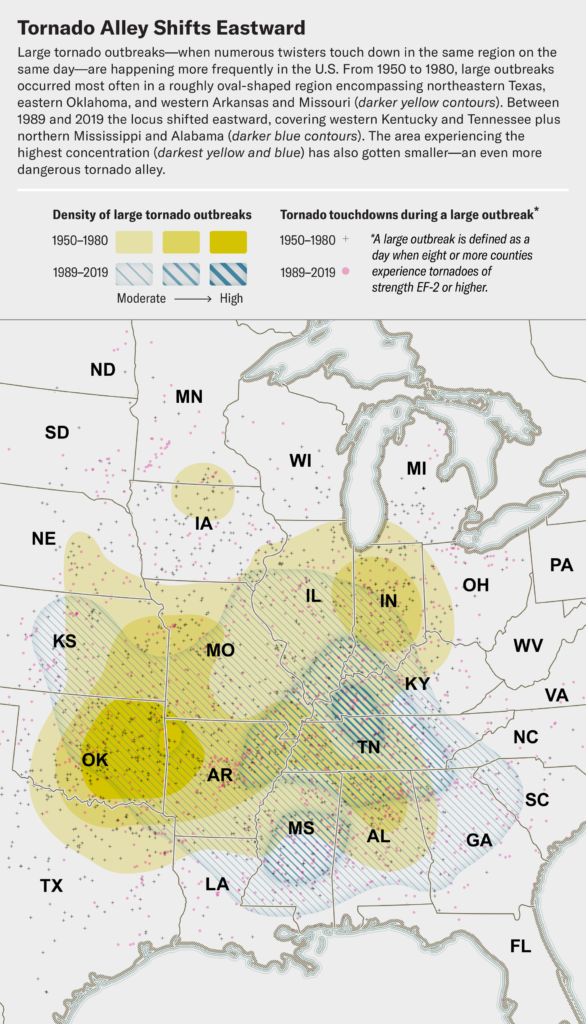

Oklahoma recorded 106 tornadoes in 2025 according to the National Weather Service. This is an almost 250% increase in frequency since the 90’s with a record high of 152 being recorded in 2024. Why is this happening, you ask? Let’s have a little science lesson! Geologists have found that Tornado Alley has been shifting East and also becoming smaller, resulting in more intense and frequent tornadoes. Here’s an illustration of the shift below:

Source: Scientific American

This shift is happening because of a combination of:

-

More Storm Fuel: Climate change creates more warm and humid air near the ground. When this wet air hits cool, dry air high up, it forms the “supercell” thunderstorms that create tornadoes.

-

An Unstable Atmosphere: As the earth warms, the air becomes more unstable. This instability acts like a spark that makes it much easier for these large storms to develop.

-

Warming Oceans: The Gulf of Mexico is getting hotter, which pumps extra water vapor into the sky. This moisture now travels much further east than it did a few decades ago.

-

Moving Boundaries: There is an invisible line that separates dry western air from moist eastern air. This boundary has shifted about 140 miles to the east, moving the “sweet spot” for tornadoes to develop into new states.

When a tornado hits a neighborhood, it creates total losses. Carriers must pay out the full replacement cost of hundreds of homes simultaneously. To remain solvent, insurers spread this massive risk across all policyholders in the state. Hence, your monthly premiums go up.

The Hidden Cost of Hail

While tornadoes get the headlines, hail causes more consistent financial damage. Oklahoma experiences approximately 297 hail events annually, resulting in an average of $80.4 million in yearly damage losses. According to an Insurify study, Oklahoma ranks as the fourth most vulnerable state in the nation for these costly storms. Severe hailstorms damage roofs, siding, and vehicles, so as you can imagine, a single storm can trigger thousands of claims in a single afternoon.

Insurers in Oklahoma often struggle with profitability due to these weather patterns. The “combined loss ratio”— the math of premiums collected versus claims paid — has hovered around 110% recently. This means for every $100 an insurer takes in, they pay out $110 in claims. To fix this math, rates must rise.

Why Car Insurance Is So High in Oklahoma

If you drive in Tulsa or Oklahoma City, you likely pay more for car insurance than friends in neighboring states. The reasons go beyond just your driving record.

The Uninsured Driver Crisis

Oklahoma consistently ranks as one of the worst states for uninsured motorists. Statistics show that roughly 25.9% of Oklahoma drivers do not have insurance. This means you have a 1 in 4 chance of being hit by someone who cannot pay for the damage.

Because so many drivers break the law, those who do buy insurance must pay more. Your policy includes “Uninsured Motorist” (UM) coverage to protect you from these drivers. The high risk of UM claims in Oklahoma directly inflates your monthly premium.

Vehicle Technology and Repair Costs

The cost to fix a car in Oklahoma has skyrocketed. Modern vehicles feature complex sensors, cameras, and advanced safety systems. Even a minor “fender bender” now requires expensive recalibration of these sensors.

Inland states like Oklahoma also face higher costs for shipping parts and materials compared to coastal hubs. Combined with a shortage of skilled technicians, labor rates for auto repairs have increased significantly.

Home Rebuilding and Inflation Pressures

Oklahoma homeowners insurance rates are also climbing because of the rising cost of “Replacement Value.”

The Cost of Materials

Building a home today costs much more than it did five years ago. Prices for lumber, drywall, and electrical components have surged due to national inflation and supply chain issues. When an insurer calculates how much it would cost to rebuild your home after a total loss, they must use today’s prices, not what you paid for the house.

Roofing Expenses

In Oklahoma, the roof is the most vulnerable part of the house. The cost of shingles and skilled roofing labor has increased. Many insurers are now moving toward “Actual Cash Value” for older roofs or requiring impact-resistant shingles to help mitigate these costs. To help homeowners, the government has launched the statewide OKReady grant to subsidise the costs of fortifying roofs against storms. Learn more about the Strengthen Oklahoma Homes program here.

Oklahoma’s Regulatory Environment: “Use-and-File”

The way Oklahoma regulates insurance companies differs from most other states.

Use-and-File System

Oklahoma operates on a “use-and-file” system. This allows insurance companies to implement new, higher rates immediately and file the paperwork with the state afterward. In “file-and-use” states, regulators must often review or approve the rates before they take effect.

Critics argue this “hands-off” approach allows for faster and more frequent rate hikes. However, regulators argue that this system keeps the market competitive by allowing companies to adjust quickly to escalating losses.

Comparing the Numbers: Oklahoma vs. The Nation

To understand the gap, look at the median costs for 2026.

| Insurance Type | Oklahoma Average (Approx) | National Average (Approx) |

| Homeowners Insurance | $6,210 | $2,110 |

| Full Coverage Auto | $2,226 – $2,753 | $2,697 |

Note: Home insurance in Oklahoma is nearly triple the national average in some studies due to the extreme weather risks of the region.

How to Lower Your Insurance Costs in Oklahoma

While we cannot change the weather or the number of uninsured drivers, you can take steps to manage your own business insurance or personal policies.

-

Bundle Your Policies: Combining your Car Insurance and Home Insurance with the same carrier often yields the largest discount. See our full breakdown of renters insurance cost in Tulsa to understand pricing and bundle savings.

-

Invest in Resilience: Upgrading to a Class 4 impact-resistant roof can lead to significant premium credits in Oklahoma. Programs like “Strengthen Oklahoma Homes” offer grants for these upgrades.

-

Review Your Deductible: Increasing your deductible from $1,000 to $2,500 can lower your annual premium, provided you have the savings to cover the higher out-of-pocket cost if a claim occurs.

-

Monitor Your Credit Score: In Oklahoma, insurers use “insurance scores” based on credit history to help determine your rate. Maintaining good credit can lower your insurance costs by thousands of dollars over time.

-

Shop Around Regularly: The “best” company for you changes as your life changes. Working with an independent agent like Zoellner Insurance allows you to compare multiple carriers at once to ensure you are not overpaying.

Frequently Asked Questions

Why is my homeowners insurance higher than my mortgage?

In some Oklahoma cities, the annual insurance bill now exceeds property taxes and basic maintenance combined. This is primarily due to the state’s position in Tornado Alley and the high frequency of hail claims.

Does Oklahoma have an “insurance of last resort?”

Unlike many states, Oklahoma does not have a “Fair Plan” or state-funded insurer of last resort. However, Commissioner Glen Mulready notes that Oklahoma does not have an availability issue; companies are willing to write policies, but affordability remains the challenge.

Are there new laws coming to help?

The Oklahoma Insurance Department announced a 2026 legislative package aimed at increasing transparency and shortening the time insurers have to respond to claims. These reforms include legal changes to disincentivize frivolous lawsuits, which can drive up costs for everyone.

Expert Guidance from Zoellner Insurance

Insurance in Oklahoma is complex. Whether you need Renters Insurance, Mobile Home Insurance, or a specialized Life Insurance policy, we are here to help you navigate the market.

We understand the local Tulsa and Oklahoma City landscapes. We know which carriers are currently offering the best value for Oklahomans and how to find the discounts you deserve.

Would you like us to review your current policies to see if we can find a better rate for you? Visit our FAQ Hub or contact us today for a personalized quote.